Reasons why taking an Education Loan is always a good idea when it comes to overseas education

Latest post

Archives

Tags

Education Loan Personal Loan SME Loan Tips & Advice Home Loan Two Wheeler Loan

Education is the best asset you can have in order to make progress in your career. Anyone that looks to pursue further studies needs to have a plan to ensure the funding of their desired course.

While a lot of students choose to take financial support from their family members, some delay their education by some years till they save up the funds. And many a times this delay can result in plans being dropped entirely.

The best option is to take an Education Loan, which will make your life much more easier as well provide a lot of additional benefits. Read on to find out all about these benefits.

December 11, 2019

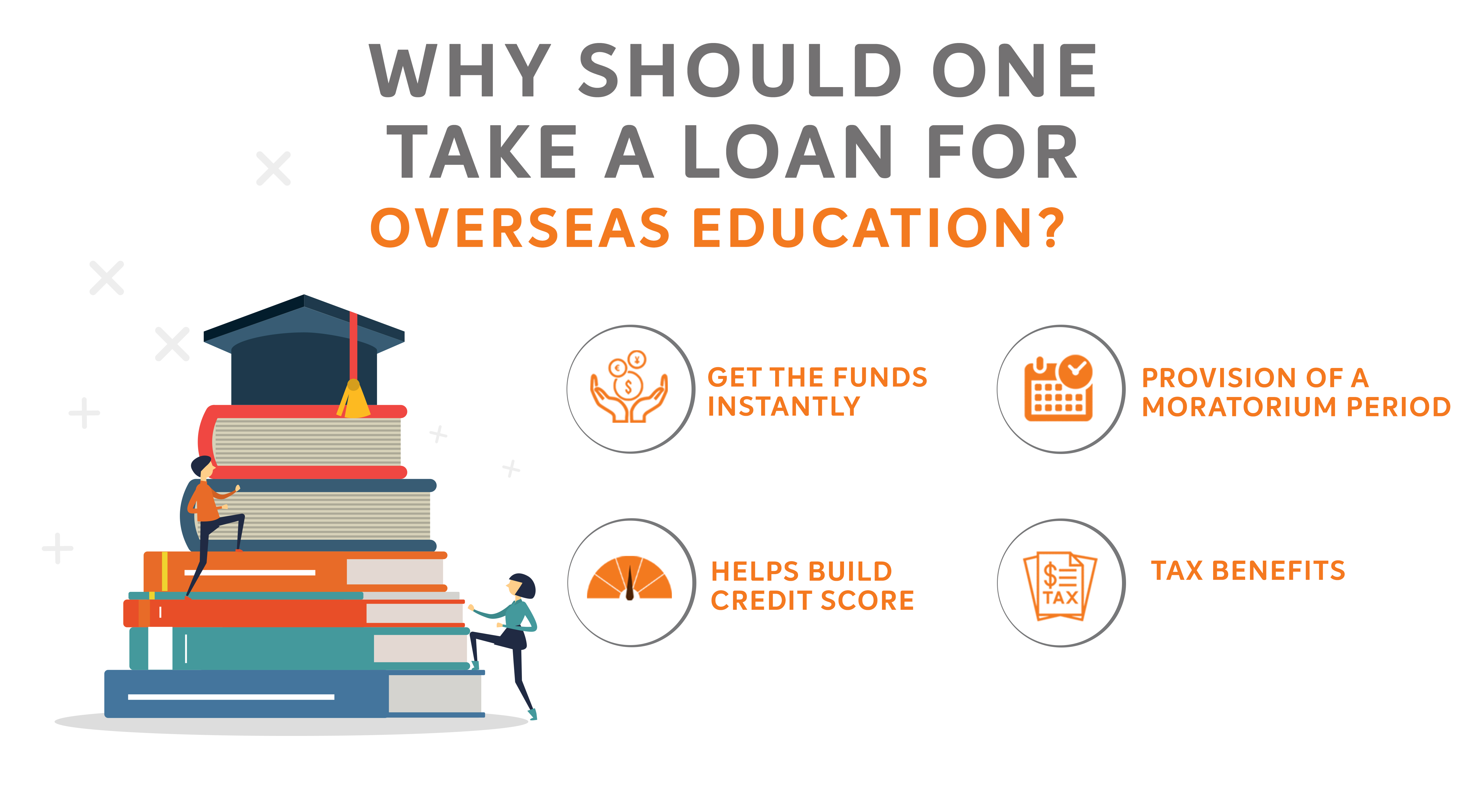

Get the funds instantly

Once the loan is sanctioned, the students do not have to worry about arranging money for academic expenses anymore. They can focus better on their studies when they do not have the burden of worrying about the funds for their education.

Their expenses are all taken care of by the Education Loan providers, which then have to paid back in monthly installments. This gets convenient for the students, who then do not have to put a hold on their dreams of pursuing a course they are interested in.

Provision of a moratorium period

When you take an Education Loan from a financial institution, they will provide you with a moratorium period. This period is a grace period where the student does not have to pay any amount back to the loan provider. The duration of this period is generally for 6 months after the students complete their graduation, or 3 months after they get employed.

This is a very helpful feature, as students get some time to find a good job and save some money till the repayment period starts. Students can however choose to start repaying the loan even before they complete the course. This is a great step, as they would be doing themselves a favour by reducing the total loan amount left to be cleared by the time they are done with the course.

Helps build credit score

This may not seem so important for the students at this point in their lives as it may not affect them so much as of today. But when they may need bigger loans in the future for any reason like getting married and buying a house, their credit scores are going to play a big role.

The financial institutions review credit scores of applicants, and this has a big say in the sanctioning of the loan. Taking an Education Loan and successfully paying it off, is a great way for the students to build their credit scores by paying off the loan on time.

Tax benefits

Another benefit of taking an Education Loan is that you can claim tax deductions. The interest rate that is charged on the Education Loan you have taken can be claimed as tax deductions as per Section 80E of the Income Tax Act.

Hope this article has helped you, all the best! To know more about our Education Loans simply call us at 1800 102 2192.